XR Report: More than $4.1 Billion Was Invested in AR and VR in 2019

Digi-Capital has released a 370-page Augmented Reality/Virtual Reality Report for the Q1 of 2020 as well as a 500,000 data point AR/VR Analytics Platform. The company’s Analytics Platform tracked $4.1 billion in AR and VR investments last year, making 2019 the third-highest year on record when it comes to virtual reality and augmented reality investments.

The investments in AR/VR, however, saw a drastic drop during the fourth quarter of 2019 compared to the third quarter of the same year in terms of the deal volume (the number of deals) as well as the dead value (the amount invested).

Should this drop in investments in Q4 be a harbinger of things to come in 2020 and beyond, then the AR/VR startups might have to begin exploring new sources of financing such as revenue generation while also managing their burn rates more prudently in 2020 instead of focusing purely on leveraging VC investment to accelerate growth.

Digi-Capital’s tracking of the first two quarters of 2020 will paint a clearer picture on where investments in AR and VR are headed in the coming year and beyond.

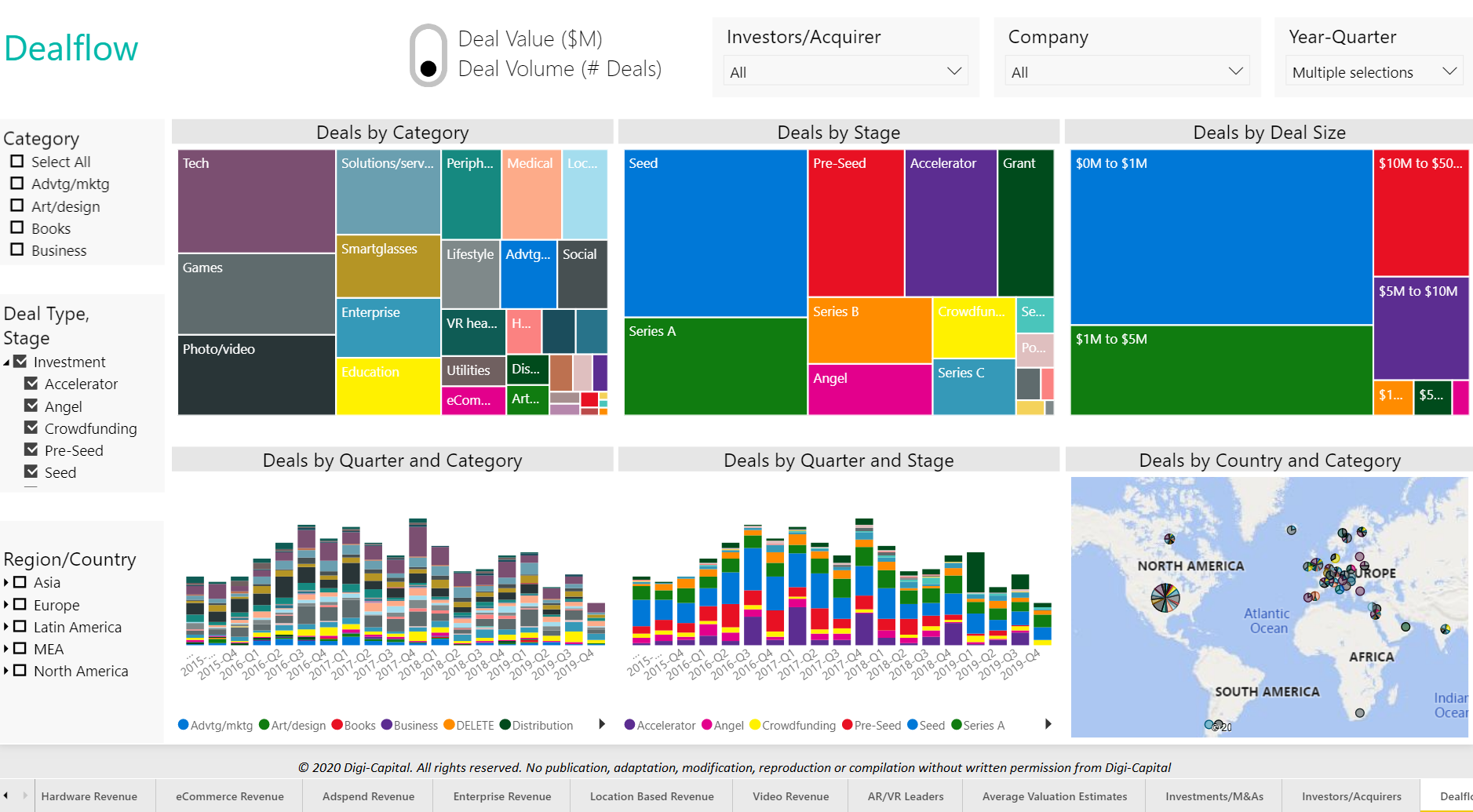

The AR/VR Investments Dealflow (Number of Deals)

During the third quarter (Q3) of 2019, it appeared as if the AR/VR deal volume stabilized but it soon saw a significant decline in the fourth quarter. The total volume of investments went down 27% in 2019 as compared to 2018.

The categories that witnessed the highest volume of deals over the past 12 months were in games, AR/VR tech, education, medical, smartglasses, enterprise software/services as well as solutions/services. All of these categories witnessed fewer number of deals in 2019.

The AR/VR investment value (the amount of dollars invested) dropped 35% in 2019 compared to 2018. The deal value also saw a significant drop in the fourth quarter of 2019 compared to the third quarter. Quarter 1 has also been slower so, together, these contributed to the overall decline in investment in 2019.

The deal value was dominated by AR/VR tech as well as the social companies. Also significant in 2019 in terms of the deal value were investments in location-based entertainment, smartglasses and games. Other categories also received investments but at a lower level.

In terms of the volume of investments by stage, the largest inflows came from Grants, Seed, Series A, Accelerator, Crowdfunding and Series B funding. The other stages had fewer deals over the course of last year.

All the other high-value investments were all Series F, Series A, Series C, Series B and Series D except Snap’s post-IPO private placement in 2019. The other stages all raised smaller amounts of investments.

When deal sizes are factored in, the amount of dollars invested was dominated by investment rounds in the range of $500 million to $1 billion and those in the range of $100 million to $500 million. These were followed by investment round in the range of $10 million to $50 million and then those in the range of $50 million to $100 million size deals. Coming last were the early stage rounds at lower levels.

In terms of the geographical factor, the US and China still dominated AR/VR investments last year, just like in the previous years. Coming third was Israel followed by UK and Canada. All other countries had lower AR/VR investments levels in 2019.

So far, the AR/VR industry is witnessing fewer M&A deals compared to other technological sectors. In 2019, there were just $700 million worth of M&A deals.

The biggest mergers and acquisitions in 2019 happened in AR/VR solutions/services, games, smartglasses, tech and lifestyle. There were other lower level acquisitions in multiple other categories. There have only been a few big AR/VR M&A deals. The rest of the quarterly AR/VR M&As have been in the tens to hundreds of millions of dollars for every quarter since 2014.

Should the much-anticipated market inflection point materializes in the next few years, we will likely see an uptick in M&A activity. For the short term, however, there doesn’t appear to be an obvious catalyst that could trigger frenzied M&A activity.

2020 has been billed as a potentially transitional year for the AR/VR industry but it remains to be seen whether the level of investments seen in 2019 could continue in 2020. There are also macro factors such as COVID-19 pandemic that could significantly impact the tech market investments in a much broader way beyond just the AR/VR. It will be interesting to see how the first half of 2020 will pan out and whether the AR and VR deals will continue surging or whether they will stay at the current level.

https://virtualrealitytimes.com/2020/03/13/xr-report-more-than-4-1-billion-was-invested-in-ar-and-vr-in-2019/https://virtualrealitytimes.com/wp-content/uploads/2020/03/Digi-Capital-AR-VR-Investment-Value-by-Countries-in-2019-600x338.jpghttps://virtualrealitytimes.com/wp-content/uploads/2020/03/Digi-Capital-AR-VR-Investment-Value-by-Countries-in-2019-150x90.jpgTechnologyTechnology DiscussionDigi-Capital has released a 370-page Augmented Reality/Virtual Reality Report for the Q1 of 2020 as well as a 500,000 data point AR/VR Analytics Platform. The company’s Analytics Platform tracked $4.1 billion in AR and VR investments last year, making 2019 the third-highest year on record when it comes to...Sam OchanjiSam Ochanji[email protected]SubscriberVirtual Reality Times - Metaverse & VR