Is the Crypto Market Beginning to Recover?

The cryptocurrency market and the whole ecosystem are finally showing signs of recovery after a two-year bear market that saw prices plummet from their 2021 peak. Over the past two weeks, we have been witnessing a surge in crypto prices and NFT sales.

The two biggest cryptocurrencies by market cap remain Bitcoin (BTC) and Ethereum (ETH). Both have seen their prices surge in the past 30 days, with a gain of 30% and 28% respectively, according to data from CoinMarketCap. The total crypto market rose 31% to hit $1.41 trillion over the same period.

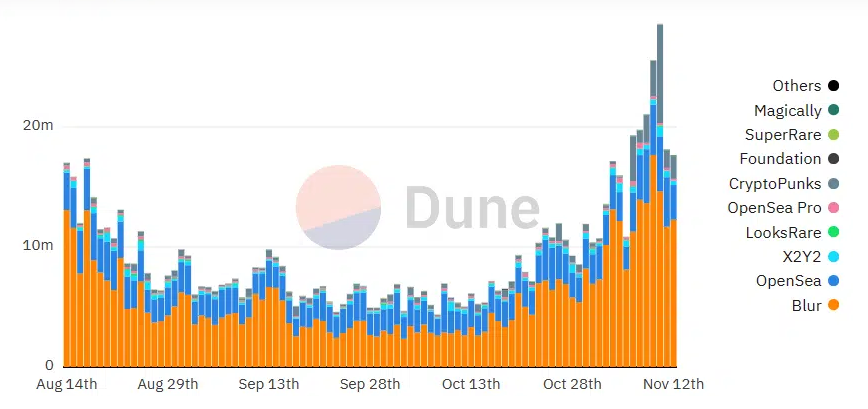

The non-fungible token (NFT) market pace also gained in the recent hype cycle, recovering temporarily from the 2021 and 2022 market tumble. Total NFT sales rose 64% over the past 30 days with some collections hitting a new price peak for the first time in more than two years, according to data from CryptoSlam.

Ethereum, Bitcoin, and Solana were the top three blockchains by NFT sales volume, with each registering a 44%, 1,222%, and 56% increase in sales respectively over the same time frame.

The crypto venture capital landscape is also beginning to see some action following a slump in web3 investments over the past six consecutive quarters. The bullish turn is coming after an extended market downturn as well as a dampening in consumer and investor interest in the crypto market.

Another bullish trend can be seen in the digital asset investment products that have seen $293 million in inflows over the past week which brought the seven-week run in the inflows to more than $1 billion, taking the year-to-date inflows to $1.14 billion. The inflows made 2023 the third highest on record.

ETF Optimism Also Positively Contributing to the Market Sentiment

The launch of a spot Bitcoin ETF generated some optimism that has further contributed to the recent crypto market rally which drove the price of the flagship cryptocurrency to $38,000. The much-awaited spot BTC ETF is coming closer to reality according to analysts at Cantor Fitzgerald, a financial services firm.

Cantor Fitzgerald performs prime brokerage and investment banking services and is increasingly confident of the approval of applications from asset managers planning to launch spot Bitcoin ETF.

So far, there has been hesitation from the SEC on the approvals of spot Bitcoin ETF, triggered by concerns over their possible manipulation on the offshore spot platforms. According to Cantor Fitzgerald, these concerns are misplaced as the market surveillance procedures being floated by the new applicants address some of the SEC’s worries and could sway the regulatory authority towards the approval of spot bitcoin ETFs.

Ripple CEO Brad Garlinghouse is confident that new capital will flood into the crypto market should spot BTC ETF be approved. He, however, admits that balancing these positive developments will be difficult against other macro factors such as the ongoing wars in Europe and the Middle East. Garlinghouse added that the crypto industry still required not just regulatory clarity but also “lots of utility” to flourish.

https://virtualrealitytimes.com/2023/11/19/is-the-crypto-market-beginning-to-recover/https://virtualrealitytimes.com/wp-content/uploads/2018/03/Proof-of-Stake-Cryptocurrency-600x337.jpghttps://virtualrealitytimes.com/wp-content/uploads/2018/03/Proof-of-Stake-Cryptocurrency-150x90.jpgBusinessCryptocurrencyThe cryptocurrency market and the whole ecosystem are finally showing signs of recovery after a two-year bear market that saw prices plummet from their 2021 peak. Over the past two weeks, we have been witnessing a surge in crypto prices and NFT sales. The two biggest cryptocurrencies by market cap...Sam OchanjiSam Ochanji[email protected]EditorVirtual Reality Times - Metaverse & VR